0.5 in 2025

The Swiss National Bank cut its policy rate by 25 bps to 1% in September 2024, a third consecutive reduction. For 2025, the Bank expects inflation to be comfortably below 1%. Further interest rate reductions are expected by UBS in December and March 2025 - pointing to a 0.5% base rate next year. As discussed recently in French Ski Property and Interest Rates, in the current environment, further cuts are expected in many countries.

Switzerland may appear to be expensive for non-Swiss Franc visitors and investors, but the lower interest costs are among the many benefits of asset ownership in the country. To name a few:

- Stable politics

- Safe haven currency

- Attractive tax deals

- First class transport, healthcare & education

- Climate and quality of life

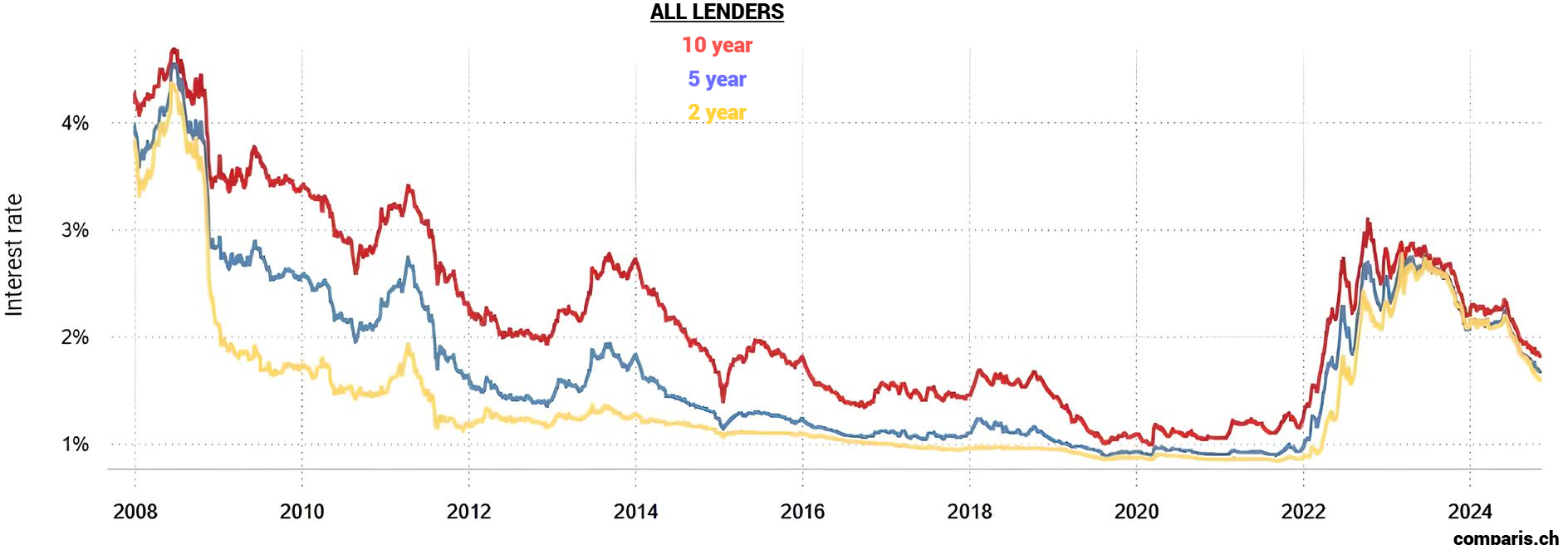

Mortgage rates in Switzerland are among the lowest in the world

APi caught up with a well established Cantonal Bank recently, their 10 year fixed rates are in the 1.4 to 1.9% range depending on the type of loan, including interest only - with an Asset Management arrangement the rate is lower. LTVs are up to 70%.

Ski property is favoured by the banks, due to the Lex Weber regime limiting supply. Ski property asset values are underpinned by restrictions on new building. As is the case in French ski resorts, new developments with an obligation to rent are considered difficult to lend against, as they are potentially harder to sell.

In general, we are impressed with the ‘open-for-business’ attitude of this Cantonal Bank, including for non-residents, and even for US citizens who for many years were considered problematic following the introduction of FATCA in 2010. They know their areas well with branches in most ski resorts and their lending growth is outpacing that of the market in general. 95% of properties they lend against are valued in line with market levels. Applications usually take 1-2 weeks.

Fiscal advantages

Fiscally, it can be beneficial to take out a mortgage in Switzerland. Interest costs can be deducted from the imputed rental value of the property. Wealth tax can also be reduced.

APi is here to help

Navigating the ownership restrictions in Switzerland is unfamiliar territory for many non-Swiss prospective buyers. And with all these benefits, it is hardly surprising that the market is short of stock - just 0.7% according to the last UBS report. Property prices in the major Swiss ski resorts, in our opinion, are more likely to continue gently increasing.

Our extensive network and local knowledge will save you much time and frustration.

Feel free to give us a call for an initial consultation, or just a friendly chat.